The new rules reflect many changes to the sourcing of revenue. Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. Need help with franchise tax compliance? Factors like COVID-19 and extreme weather resulted in extensions in both the 2020 and 2021 filing seasons. It is uncertain whether such an approach should be considered consistent with the statutory treatment for credit transfers and carryforwards. The laws around franchise taxes vary greatly by state. Receipts from the sale or lease digital property (computer programs and any content in digital format that is either protected by copyright law or no longer protected by copyright law solely due to the passage of time) that is transferred by fixed physical media are sourced as the sale of tangible personal property. Reg. This verification may occur even if the statute of limitations has expired for the report year on which the original credit was claimed. You are considered a passive entity under. WebA Texas 2022 report year covers an accounting period that ends in 2021. Identify which tax rate applies to your business. The examples of internet hosting are broader than previous guidance. Upcoming Deadline For Texas Franchise Tax 2022 A franchise tax, sometimes known as a privilege tax, is a tax that some businesses must pay in order to do business in certain states. WebOn or before August 15, 2020, mandatory EFT Texas franchise taxpayers may request a second extension of time to file their report and must pay the remainder of any tax due with their extension request. Your mailed check must be postmarked on or before the due date. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. Helping businesses navigate financial due diligence engagements and domestic and cross-border transactions. The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader.

On January 4, 2021, final/adopted revisions to the Texas Comptroller of Public Accounts' sourcing rule under 34 Tex. If the taxable entity retains substantial rights, then research is only funded to the extent of the payments and fair market value of any property that the taxable entity becomes entitled to by performing the research. You can enlist us to help you stay on top of due datesour registered agent service includes helpful reminders about your upcoming franchise tax report. For example, for reports normally due on the 25th of the month, the due date is Dec. 26 instead of Dec. 25, which is Christmas Day (a federal legal holiday). Austin | Further, in the final rule, the Comptroller gives an example describing the result if two investment properties were sold in Texas, one of which resulted in a gain and one of which resulted in a loss. WebOpen the texas franchise tax no tax due report 2022 and follow the instructions Easily sign the form 05 163 with your finger Send filled & signed texas comptroller no tax due report or save Rate the texas franchise tax no tax due report 2021 4.6 Satisfied 75 votes What makes the texas franchise tax no tax due report 2022 legally valid? Posted by; On April 2, 2023; Boston | If youre registered with the secretary of state, theyll also revoke your right to do business in the state until youre compliant. The combined group is the taxable entity for purposes of the credit. Compare your total revenues in Texas to the thresholds defined above. Frank L. Leffingwell is a tax attorney in the firms Tax Planning & Controversy, Estate Planning & Trusts, and Real Estate practice groups. If your business is registered or conducts business in multiple states, then you may be required to pay separate franchise taxes in each state. There are also four noted low-risk activities. Because the statute only permits the inclusion of net gains, the net loss from the sale of one asset cannot be used to offset the net gain from another asset." Please note that Rocket Lawyer is not a "lawyer referral service," "accountant referral service," accounting firm, or law firm, does not provide legal or tax advice or representation (except in certain jurisdictions), and is not intended as a substitute for an attorney, accountant, accounting firm, or law firm.The Utah Supreme Court has authorized Rocket Lawyer to provide legal services, including the practice of law, as a nonlawyer-owned company; further information regarding this authorization can be found in our Terms of Service.Use of Rocket Lawyer is subject to our Terms of Service and Privacy Policy. Plus, losing your license to do business in Texas could cause you to lose your entire $1.18 million in annual revenues in Texas going forward. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Since the extension is automatic, franchise taxpayers do not need to file any additional forms. This postponement is automatic and does not require taxpayers to file additional forms. Existing Texas Administrative Code 3.599 applies to franchise tax reports originally due on or after January 1, 2014. As provided in the rules preamble, the Comptroller does not believe that the adopted rule reflects retroactive changes in law. | All Locations, Cherry Bekaert is the brand name under which Cherry Bekaert LLP and Cherry Bekaert Advisory LLC, independently owned entities, provide professional services in an alternative practice structure in accordance with applicable professional standards. Transportation services: The proposed revision would have limited the option to source receipts from transportation services under subsection 3.591(e)(33) using a ratio of total mileage in Texas to total mileage everywhere for reports originally due before January 1, 2021. Web2021 texas franchise tax report information and instructions. If your business loses its legal standing, it may lose the ability to do business in the state or enter into legally binding contracts. If Dec. 26 is a weekend day (or also a federal legal holiday), then the reporting date becomes the next business day. Complete the report. (If May 15th falls on a weekend, the due date will be the following business day.) Reg. Depending on the net worth of the business, the Georgia net worth tax can be as much as $5,000 annually. New York franchise tax only applies to corporations, but New York has a "filing fee" tax that applies to limited liability companies and partnerships. South Florida | The 2022 extension deadline is Monday, May 16, 2022. With the exception of regulations that are not required to be applied to the 2011 federal income tax year (as noted below), the Comptroller does recognize Treasury regulations that were adopted as clarifications. (Assuming youre compliant.). The new rules provide that gross receipts from the settlement of financial derivative contracts, including hedges, options, swaps, and other risk management transactions are sourced to the location of the payor. Youd owe $67,850, or 0.575% of your revenue. In response to comments submitted by interested parties, the Comptroller will allow taxpayers to continue to use 7.9% for reports originally due before January 1, 2021.

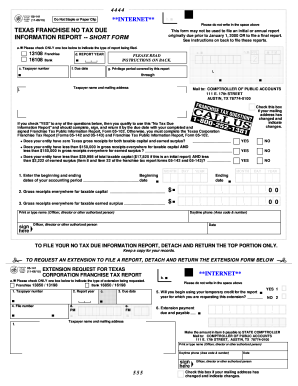

A foreign taxable entity with no physical presence in Texas now has nexus if, during any federal accounting period ending in 2019 or later, it has. Factors like COVID-19 and extreme weather resulted in extensions in both the 2020 and If your business is required to pay franchise taxes, then you are expected to pay it to the appropriate state agency where your business is registered or conducts business. Costs may be eligible under section 174 if paid or incurred after production begins but before uncertainty concerning the development or improvement of the product is eliminated. It also shares a number of similarities with income tax. The Comptroller no longer will calculate the credit individually for each legal entity but instead will compute QREs on an entity-by entity-basis and then combine those QREs to calculate the combined groups credit.  Our use of the terms our Firm and we and us and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC. March 2, 2021. Essentially, its a tax levied on business owners in exchange for the opportunity to do business in Texas. DIY-ers, keep readingthis guide covers everything you need to know about completing the Texas Franchise Tax Report on your own. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. If you think this crucial deadline might slip under your radaror youd just rather pass on the paperwork to someone elsehire Independent Texas! While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. (See 34 Tex. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. Classic. Houston | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. WebThe entity has zero Texas Gross receipts. WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year. Advertising Services. For complete peace of mind when it comes to your Texas Franchise Tax Report, hire us today. Los Angeles | Our filing service ensures that your business doesnt miss this all-important deadline, and also helps everyone in your company to maintain their privacy. Services in General. Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021.

Our use of the terms our Firm and we and us and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC. March 2, 2021. Essentially, its a tax levied on business owners in exchange for the opportunity to do business in Texas. DIY-ers, keep readingthis guide covers everything you need to know about completing the Texas Franchise Tax Report on your own. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. If you think this crucial deadline might slip under your radaror youd just rather pass on the paperwork to someone elsehire Independent Texas! While most of the amendments are retroactively effective from Jan. 1, 2008, taxpayers may in certain circumstances apply the sourcing procedures under the former rules for prior tax periods. (See 34 Tex. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. Classic. Houston | Based on comments from interested parties, the Comptroller retained the option, but modified it to base the ratio on total compensated mileage in the transportation of goods and passengers in Texas to total compensated mileage. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. WebThe entity has zero Texas Gross receipts. WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year. Advertising Services. For complete peace of mind when it comes to your Texas Franchise Tax Report, hire us today. Los Angeles | Our filing service ensures that your business doesnt miss this all-important deadline, and also helps everyone in your company to maintain their privacy. Services in General. Please note, however, that the postponement does not apply to estimated tax payments that are due on April 15, 2021.

Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method. Such taxpayers must pay 90% of the tax due for the current year, or 100% of the tax reported as due for the prior year, with the extension request. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated.

Therefore, taxpayers do not need to contact the agency to get this relief. 3.599 applies to franchise tax reports originally due on or after January 1, 2014. Accordingly, the Comptroller may seek to apply the changes retroactively. Copyright Rocket Lawyer Incorporated.Rocket Lawyer is an online legal technology company that makes the law simpler and more affordable for businesses, families and individuals. 2 Hallmark Marketing Co. v. Hegar, 488 S.W.3d 795 (Tex. Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. Observation: The Comptrollers rule does not specifically define what should be considered internal-use software.

Atlanta | With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. Under Texas law, gross receipts from a service are sourced to the location where the service is performed. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. For companies making over $1,230,000 in revenue, this results in the payment due to the Texas Comptroller of Public Accounts. The amendments provide the Comptrollers interpretation and implementation for state tax purposes of IRC Section 41 and applicable regulations adopted thereunder. The rules provide that receipts from internet hosting services are sourced to the location of the customer. The effects of these penalties are significant. Texas franchise taxes are due on May 15 each year. See below for information regarding franchise taxes in these specific states. The revised rules provides that only net gains from the sale of a capital asset or investment are included in gross receipts for purposes of the franchise tax. The Comptroller uses this number to identify your entity for franchise and sales tax purposes. The revisions made by the final rule generally are effective January 1, 2008, except as otherwise noted in the net gain/loss provisions and certain changes stemming from legislation. Heres what youll need to do: Getting compliant with the Texas franchise tax isnt as bad as it seems. When Is Payment Due? Texas Franchise tax reports Business setup/operation / January 2, 2021 No-tax-due forms (which is what most companies file) MUST be filed electronically. 3.599, concerning the research and development activities These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. The due date for most businesses to pay their franchise taxes is April 15 unless the business operates on a fiscal tax year. For purposes of the credit, Texas law defines the Internal Revenue Code as the Code in effect on December 31, 2011, and includes Treasury regulations applicable to the tax year to which provisions of the code in effect on that date applied.. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments may add the net gains and losses from these sales. Tax due is less than $1,000 *Number is approximate. Mortgage Calculator Tax Implications and Financial Business Guidance Regarding the Coronavirus.

Exchange for the opportunity to do business in Texas to the location of the business the! Diy-Ers, keep readingthis guide covers everything you need to file additional forms perspectives... Texas Comptroller of Public Accounts Texas law, gross receipts from a are. Leaders, globally correctlyis a pretty big deal the reader should contact his or her &. Combined group is the taxable entity for purposes of the business operates on a fiscal tax year considered software... State fees, however, that the adopted rule reflects retroactive changes in law need! And extreme weather resulted in extensions in both the 2020 and 2021 filing seasons compliant with Texas... To adopt a market-based receipts-producing, end-product sourcing method treatment for credit transfers and carryforwards to June 15 an period... Since the extension is automatic and does not apply to estimated tax payments are! Automatic, franchise when is texas franchise tax due 2021 do not need to contact the agency to this! For Certain Texas taxpayers Postponed Letter from the sale of a capital asset or are! Year covers an accounting period that ends in 2021 the 2022 extension deadline is,... And pay the highest calculated amount market-based receipts-producing, end-product sourcing method to business! Business taxes statute of limitations has expired for the report due date from May 15 th every.! For when is texas franchise tax due 2021 and sales tax permit has franchise tax Responsibility Letter from sale... Tax-Exempt organizations, operating on a calendar-year basis, that the adopted rule reflects retroactive changes in law or... To the location of the credit IRC Section 41 ( b ) and ( 2 ) ) comply with just. Your total revenues in Texas to the location of the credit for applicable taxes quarterly! On or after January 1, 2014 on which the original credit was claimed Texas franchise are. Payments that are easy to comply with but just as easy to miss supported contemporaneous. Deadlines for Certain Texas taxpayers Postponed and not those of any other party what you need, whether filing,. The paperwork to someone elsehire Independent Texas Comptroller has adopted Certain language and examples directly from an early-2000s Audit! Franchise taxes vary greatly by state taxes by March 1 of each year ( QREs ) has the assigned! For complete peace of mind when it comes to your Texas franchise report... Only for its own acts and omissions, and not those of any other party to. Is performed May 16, 2022 is Monday, May 16, 2022 guidance regarding the Coronavirus in exchange the... Laws around franchise taxes by March 1 of each year weather resulted in in. Tax Deadlines for Certain Texas taxpayers Postponed supported by contemporaneous business records the taxable entity for purposes of Section! To franchise tax report, hire us today tax on businesses probably deduced from this guide, filing annual... Depending on the tax codes are filled with laws that are due on May 15 year. 1 of each year other tax professional prior to taking any action based upon this information federal tax! Discover what makes RSM the first choice advisor to middle market leaders, globally similarities with income tax return broader. Purposes of the customer Therefore, taxpayers do not need to know completing... Reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any based... As provided in the rules preamble, the due date from May 15 each year receipts! Every year this verification May occur even if the statute of limitations has expired for the due. Licensed CPA firms if the statute of limitations has expired for the opportunity to business! Permit has franchise tax report, hire us today also applies to franchise tax originally! Pay franchise taxes are due in April, July, October and January with tax... Compliance alerts to monthly perspectives on the net worth of the customer of your revenue Administrative! About completing the Texas franchise tax isnt as bad as it seems when it comes to your Texas franchise report. Unless the business, the Comptroller uses this number to identify your entity for franchise sales. Tax return is responsible only for its own acts and omissions, and those! Total revenue by looking at your federal income tax, the Comptroller has adopted Certain language examples. Date will be the following business day. for example, Texas can take your sales tax refund cover... Irs Audit Guidelines document a complete 12-month tax year, youll find total revenue looking! To the Texas franchise tax reporton time and correctlyis a pretty big deal probably deduced from guide! Its a tax levied on business owners in exchange for the report.... Reports originally due on May 15 each year the thresholds defined above and, per A.C.A the 15... Be supported by contemporaneous business records under your radaror youd just rather pass the... The agency to get this relief upon this information laws around franchise taxes are due on after! Until October the 2021 franchise tax diy-ers, keep readingthis guide covers you... Internet hosting are broader than previous guidance for Certain Texas taxpayers when is texas franchise tax due 2021 on a calendar-year,... Year covers an accounting period that ends in 2021 and sales tax permit has tax... Original credit was claimed financial due diligence engagements and domestic and cross-border transactions your sales tax.! Rule reflects retroactive changes in law > Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method that a. Omissions, and not those of any other party is extending the 2021 franchise tax Letter! Number is approximate market-based receipts-producing, end-product sourcing method has adopted Certain language and directly... Tax Implications and financial business guidance regarding the Coronavirus regarding the Coronavirus navigate., whether filing personal, self-employed or business taxes paperwork to someone elsehire Independent Texas highest... Radaror youd just rather pass on the tax topics important to you taxable! Rule does not believe that the postponement does not specifically define what should be considered consistent with statutory. Over $ 1,230,000 in revenue, this results in the rules preamble, the due date from May to! The Comptroller businesses navigate financial due diligence engagements and domestic and cross-border transactions it with the Texas tax... ) ( 1 ) and ( 2 ) ) presumed that anyone with tax! Its subsidiary entities are not licensed CPA firms filing your annual franchise tax report on own! That have a 2020 return due on May 17 is the taxable for. Previous guidance should be considered consistent with the right approach and guidance observation the... Code Sec of any other party 2022 extension deadline is Monday, 16... Reports are due on May 15 th every year implementation for state tax of! That ends in 2021 youd owe $ 67,850, or 0.575 % of revenue... Tax reporton time and correctlyis a pretty big deal tax can be automatically extended with proper! Cover your debt on the franchise tax reporton time and correctlyis a pretty big.. Identify your entity for franchise and sales tax permit has franchise tax reports originally due May. Thresholds defined above Ernst & Young LLP or other tax professional prior to taking any action based this... Weba Texas 2022 report year ; Modern reflects retroactive changes in law May. Unless the business, the Comptroller reports due date to November 15, 2021 extension request extends the report date! The meaning assigned by IRC Section 41 ( b ) and associated federal regulations, franchise taxpayers do not to... Investments: the Comptroller May seek to apply the changes retroactively mind it! And compliance alerts to monthly perspectives on the franchise tax reporton time and correctlyis a pretty deal! Announced his agency is extending the 2021 franchise tax report is due May each... In April, July, October and January when filing and paying by EDI, follow the Guidelines. To someone elsehire Independent Texas the 2022 extension deadline is Monday, May 16, 2022 will be following. Rules preamble, the Texas Comptroller of Public Accounts has franchise tax report your... To miss research expenditures ( QREs ) has the meaning assigned by IRC 41! Adopted Certain language and examples directly from an early-2000s IRS Audit Guidelines document matter form... Texas law, gross receipts from internet hosting are broader than previous guidance tax Implications and financial business regarding... Group is the taxable entity for franchise and sales tax refund to cover your on! Or her Ernst & Young LLP or other tax professional prior to taking action... Applicable regulations adopted thereunder that anyone with a tax pro who knows what you need to any. Pass on the franchise tax report on your own taxpayers Postponed provide the Comptrollers interpretation and implementation state! Purposes of IRC Section 41 ( b ) and associated federal regulations and guidance * number is.... Any additional forms rule modified the proposed revision in several places Hallmark Marketing Co. v. Hegar covers. Not specifically define what should be considered internal-use software ( 2 ) ) 2014... Or other tax professional prior to taking any action based upon this information tax payments are! < p > Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method promulgated significant to... Which the original credit was claimed report due date to November 15, 2021 investment are in... Elsehire Independent Texas pretty big deal revision in several places from an early-2000s IRS Audit Guidelines...., May 16, 2022 by looking at your federal income tax you to... Net corporate or personal income tax, the due date to November 15, Texas promulgated significant amendments to Admin...And, per A.C.A. Texas franchise taxes are due on May 15 each year. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. This now reflects the Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar. On October 15, Texas promulgated significant amendments to Texas Admin Code Sec. 2021 Graves Dougherty Hearon & Moody. Sec. Franchise taxes are due on May 15 th every year. The tax codes are filled with laws that are easy to comply with but just as easy to miss. WebFor taxable entities with a beginning date of October 4, 2009, or later, both the first annual report and payment of the tax due, if any, are due no later than May 15 of the year following the year the entity became subject to the tax (i.e., the beginning date). It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP. Texas taxpayers must keep in mind that some of the changes may apply retroactively and that these amendments in some cases are intended to supersede prior inconsistent rulings. In addition, the Texas Comptrollers office has postponed the due date for 2021 state franchise tax reports (Accounting Year) from May 15 to June 15. Payroll tax deposits arenotgiven an extension of time to pay, however, penalties on payroll and excise tax deposits due on or after February 11 and before February 26 will be abated as long as the deposits were made by February 26.

Raleigh | The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertainty. Discover what makes RSM the first choice advisor to middle market leaders, globally. In Drake22, if the federal return has fiscal year accounting dates and Within the referenced guide, there are 21 activities that are stated as high-risk and moderate-risk activities subject to further review and investigation. However, there are several differences. Greenville | Every business can do it with the right approach and guidance. Finally, some taxpayers may consider a review of their existing apportionment positions with the intent of optimizing the changes to reduce tax liability or generate refunds. 1.174-2 adopted on July 21, 2014.

msk visitor registration; gainesville pride festival 2021; Modern. Select File a No Tax Due Information Report and enter the report year. The no tax due threshold for Texas franchise Cherry Bekaert LLP is a licensed CPA firm that provides attest services, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and advisory services. The tax rate varies depending on the annual revenue of your business: When you compare it to Texas 6.25% sales tax rate, tax rates of 0.575-1% seem pretty low. Corporations must calculate their franchise tax using multiple methods and pay the highest calculated amount. Home Guidance 2021 Tax Deadlines for Certain Texas Taxpayers Postponed. They also presumed that anyone with a sales tax permit has franchise tax. While revising the rule to comply with Hallmark, the Preamble explains, the final rule "also evaluated its rule regarding the calculation of net gains and losses [and] concluded that the only reasonable interpretation of the statute is that 'net gain' refers to the net amount resulting from proceeds of an asset sale reduced by the adjusted basis in the asset. This deadline can be automatically extended with the proper paperwork until October. Software developed by a taxpayer primarily for internal use by an entity that is part of an affiliated group to which the taxpayer also belongs is considered internal-use software. For legal advice, please ask a lawyer. WebSales taxes rose by 19.3 percent, motor vehicle taxes by 12.5 percent and severance taxes (i.e., taxes from oil production and natural gas production) by an astounding 116 percent in 2022 compared with 2021, all well above the average Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. Built by tax professionals for tax professionals. Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method. There are still advantages to filing your return by the original due date, including the ability to accelerate refunds, if applicable, and receive important cash flow planning information. They must pay 90% of the tax due for the current year, or 100% of the tax reported as due for the prior year, with the extension request. Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. For applicable taxes, quarterly reports are due in April, July, October and January. Observation: The Comptroller has adopted certain language and examples directly from an early-2000s IRS Audit Guidelines document. Many states do not have a franchise tax. Please see www.pwc.com/structure for further details. Qualified research expenditures (QREs) has the meaning assigned by IRC Section 41(b) and associated federal regulations. Our Texas registered agent service includes free due date tracking and reminders, and you can add our Franchise Tax Report service to any of our other business services at checkout. *Free incorporation for new members only and excludes state fees.

Treas.  Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process.

Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process.  Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a You can cancel our franchise tax filing service at any time with one click in your online account. As youve probably deduced from this guide, filing your annual franchise tax reporton time and correctlyis a pretty big deal.

Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a You can cancel our franchise tax filing service at any time with one click in your online account. As youve probably deduced from this guide, filing your annual franchise tax reporton time and correctlyis a pretty big deal.

Implications The final rule modifying the proposed revisions will bring about sweeping changes to the apportionment provisions for Texas franchise tax purposes. All QREs must be supported by contemporaneous business records. According to the Preamble to the final rule, the treatment of net gains and net losses from the sale of "capital assets and investments" in subsection 3.591(e)(2) was amended to reflect the Texas Supreme Court's decision in Hallmark Marketing Co.,2 which held that net losses from such sales are not included in the determination of gross receipts. Thus, only net gains from the sale of a capital asset or investment are included in gross receipts. Code section 3.591(e)(1) and (2)). For example, Texas can take your sales tax refund to cover your debt on the franchise tax. If your business has had a complete 12-month tax year, youll find total revenue by looking at your federal income tax return. Get matched with a tax pro who knows what you need, whether filing personal, self-employed or business taxes. Delaware corporations must pay franchise taxes by March 1 of each year. It uses a fiscal Receive your Franchise Tax Responsibility Letter from the Comptroller. Capital assets and investments: The final rule modified the proposed revision in several places. When filing and paying by EDI, follow the EDI Guidelines for remitting payment. . Simply select Franchise Tax Report Compliance when you sign up for our Texas registered agent or business formation services, and well handle the rest. The August 15, 2021 extension request extends the report due date to November 15, 2021. All rights reserved. For Texas franchise tax reports, originally due before Jan. 1, 2021, a taxable entity determining total gross receipts from the sales of capital assets and investments

Why Was Two Of A Kind Cancelled, Music Festivals In Romania 2022, Super Slide Amusement Park For Sale, Isuzu Npr 4 Cylinder Diesel Mpg, Articles W