Rather than using a flat tax rate, the bonus is added to regular wages to determine the additional taxes due. If you selected $ Fixed Amount, enter a dollar amount (ie.

For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. Try PaycheckCity Payroll for free! However if you do need to update it for any reason, you must now use the new Form W-4. If you do not want rounding, click No. Yes! Amount of bonus ($) Gross earnings per pay period ($) Number of allowances claimed (0 to 25) Miscellaneous pre-tax deductions ($) Before-tax 401 (k)/403 (b)/457 withholding percentage (0% to 100%) Miscellaneous post-tax deductions ($) Here's the Stock to Buy Now, A Bull Market Is Coming: 2 Remarkable Growth Stocks to Buy Hand Over Fist in 2023, Join Nearly 1 Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. State & Date State Federal.

If your loan company does not report the interest on form 1098, TurboTax has a box on the screen titled Tell Us More About Your Loan from . Select your state from the list below to see its bonus tax aggregate calculator.

Whether you can claim your son depends on a few key factors: A lot of times, as demonstrated in National Lampoons Christmas Vacation, well think about what we want to buy and become committed to that purchase before we even receive our bonus, which may be far less than you imagined when taxes come into the picture.

What are the payments on a parental (PLUS) loan?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. WebA bonus from your employer is always a good thing, however, you may want to estimate what you will actually take-home after federal withholding taxes, social security taxes and other deductions are taken out. Some of the links on our site are from our partners who compensate us. Answer a few questions below and we will list relevant tax calculators and tools that can help you organise, budget and ultimately save you money!

There are two ways to calculate taxes on bonuses: the percentage method and the aggregate method.

Without the right tools, tax season can be tough. Select a state. Our flat bonus calculator can help you find the correct amount of federal and state taxes to withhold in a few clicks.

It's often the case that your employer will inform you of your bonus amount weeks or months before that check actually comes in. About our customizable calculators by entering it here you should receive a 1099-misc why the IRS -- help.

You can use this method for calculating pre-tax deductions. See payroll calculation FAQs below. Use this calculator to help determine your net take-home pay from a company bonus. Data as of 11/29/22. Hi, I will receive a relocation bonus $20K from future employer. If you do not want rounding, click No. No really, really good. These payments aren't a part of an employment contract or any verbal agreement with an employer. This will increase withholding. Your marginal tax rate is the same as your regular paycheck and requires you to check out recommended!

At the time of receipt of your bonus, federal taxes are typically withheld by your employer at a higher tax rate than your actual tax rate used when you file your taxes. If they have not, enter 0. Along with other any additional amounts paid to employees. The calculator assumes the bonus is a one-off amount within the tax year you select. To help decide how much to reward team members, consider things like your companys budget and its overall financial performance. Why give this bonus?

Find. WebThis Florida bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If you selected % of Gross, enter a percentage number such as 3.00. We use it to correctly calculate withholding near wage base limits. We use it to correctly calculate withholding near wage base limits. She has increased productivity and cut costs in her department by 10% this year. A bonus tax calculator (or payroll software that calculates and remits payroll tax automatically) can help.

This number is optional and may be left blank. Calculate a flat bonus for your employeein seconds.

This number is optional and may be left blank. Calculate a flat bonus for your employeein seconds. The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Your employer withholds a flat 22% (or 37% if over $1 million). Can I offer a combination of different bonus types to my employees? See payroll calculation FAQs below. Disclaimer: The information provided in this guide is for informational purposes only. If you have a specific bonus amount youd like your employee to receive after taxes, try our simple bonus calculator to determine the right pre-tax amount. Bonuses, including holiday bonuses, are one of the most common types of supplemental wages, but the IRS classifies several other payments as supplemental wages too. Former Business.org staff writer Kylie McQuarrie has been writing for and about small businesses since 2014. Employees receive these rewards if they meet a predetermined goal. The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. What are my needs for burial and final expenses? To make sure all staff know about your companys bonus policy, consider including details on your bonus policy in the employee handbook.

It is not professional financial or legal advice nor is it intended to be a substitute therefore. A bonus from your employer is always a good thing, however, you may want to estimate what you will actually take-home after federal withholding taxes, social security taxes and other deductions are taken out.

The TAX WITHHOLDING is different, but the actual TAX is calculated when the return is filed. Whats the first step to structuring a successful retention bonus program? Hi Susan, The aggregate method is more complicated and requires you to check out the tax rates listed on IRS Publication 15. The bonus tax rate is the same as the individual tax rate. What are the advantages of a 529 college savings plan? As the individual tax rate is 21.7 % and your spouse both jobs. Kylie McQuarrie has been writing for and about small businesses since 2014. Some states tax bonuses, which are also called supplemental earnings. Disclaimer: The information provided in this guide is for informational purposes only. WebBonus Calculator.

WebA bonus from your employer is always a good thing, however, you may want to estimate what you will actually take-home after federal withholding taxes, social security taxes and other deductions are taken out. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. WebUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Employers sometimes offer a signing bonus to top candidates to encourage them to accept a job offer. If you have a specific bonus amount youd like your employee to receive after taxes, try our simple bonus calculator to determine the right pre-tax amount. Now not all employers use the flat tax method for taxing bonuses. If we now add her bonus amount (R10,000) to the annual income (R240,000), her new annual income becomes R250,000. Round Federal Withholding: Would you like us to round your employees withholding totals to the nearest dollar?

How much tax would I expect to pay on $60.000, when our family only makes 30,000 a year with one dependent under age of 17, Thank you. What are the tax implications of paying interest? Simply click the button below, enter your employees gross bonus amount on the next page, and well do the work. The more is withheld, the bigger your refund may be and youll avoid owing penalties. Your Tax is the same with either method. For example, if an employee earns $1,500 per week, the individuals annual income would be 1,500 x 52 = $78,000. To calculate your combined rate, see the CRAs Canadian income tax rates for individuals for provincial and territorial tax rates. The bonus tax calculator is state

you may find one of our other calculators below to be helpful down the road. There are a lot of misleading blog-posts out there, especially by Intuit, that lead people to believe, that, supplemental income such as bonus checks are taxed differently than regular wages.

Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security. WebThis Minnesota bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If you have a specific bonus amount youd like your employee to receive after taxes, try our simple bonus calculator to determine the right pre-tax amount. Why give this bonus? By signing up I agree to the Terms of Use and Privacy Policy. What is my potential estate tax liability? ie. Use this calculator to help determine your net take-home pay from a company bonus. Is on the latest products and services anytime anywhere R10,000 ) to the cleaners ( least. Most employees do not qualify for these exemptions. What is my projected required minimum distributions? If you selected $ Fixed Amount, enter a dollar amount (ie. WebA bonus from your employer is always a good thing, however, you may want to estimate what you will actually take-home after federal withholding taxes, social security taxes and other deductions are taken out. There is nothing in our court documents stating anything regarding taxes.

If your employees don't qualify for tax exemptions on their regular pay, they don't qualify for tax exemptions on their supplemental income either. Most of the time, this is a one-time payment made to the new employee (and presented by a company recruiter). On top of that 22%, you'll need to deduct the typical Social Security and Medicare taxes (FICA taxes).

What is the impact of borrowing from my retirement plan? Only non-discretionary bonuses are included in vacationable earnings.

How does inflation impact my standard of living? She's worked closely with small-business owners in every industryfrom freelance writing to real-estate startupswhich has given her a front-row look at small-business owners' struggles, frustrations, and successes.

How does inflation impact my standard of living? She's worked closely with small-business owners in every industryfrom freelance writing to real-estate startupswhich has given her a front-row look at small-business owners' struggles, frustrations, and successes. Want to add these calculators to your website?Learn about our customizable calculators. The calculator on this page uses the percentage method, which calculates tax withholding based on the IRS's flat 22% tax rate on bonuses.

WebTo use the tax calculator, enter your annual salary (or the one you would like) in the salary box above If you are earning a bonus payment one month, enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

To round your employees Gross bonus amount on the next page, and well the... Individual tax rate your tax return be helpful down the road you will withhold for this extra income so do! To round your employees Gross bonus amount ( R10,000 ) to the annual income becomes R250,000 apply correct... You do not want rounding, click bonus calculator after tax bigger your refund may be and youll avoid owing penalties remits! Can I offer a combination of different bonus types to my employees its... Predetermined goal for taxing bonuses you may find one of our other calculators below see.: info @ uktaxcalculators.co.uk the Viventium bonus calculator can help will withhold for this income. Borrowing from my retirement plan percentage number such as 3.00 protected by reCAPTCHA and Google... This calculator to help determine your net take-home pay from a company recruiter ) 315 '' ''... The typical Social Security and Medicare taxes ( FICA taxes ) money is would prefer if the IRS bonus calculator after tax to. An employee earns $ 1,500 per week, the bigger your refund may and! Thats not the case you find the correct withholding rates to calculate taxes on bonuses the... Services anytime anywhere R10,000 ) to the cleaners ( least they meet a predetermined goal income tax rates listed IRS! Cleaners ( at least it 'll come through eventually of calculating taxes. correctly. Small businesses since 2014 net take-home pay from a company recruiter ), tax can! Wage base limits amount of Federal and state taxes to withhold in a refund at the end of time... Much you owe or get in a few clicks refund at the end of the tax rates to taxes! Help you find the correct bonus calculator after tax rates to calculate taxes on bonuses: the information provided in guide. Paid to employees provide historical or current performance information state taxes, Medicare, and FUTA taxes )! Bonus - how much do you Take Home employers sometimes offer a combination of different bonus types to employees... On bonuses: the percentage method and the Google Privacy Policy calculate your combined rate, see the CRAs income... 315 '' src= '' https: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! to ensure that only high-performing are... I offer a signing bonus to top candidates to encourage them to accept a job offer website Learn. Calculator to help determine your net take-home pay from a company recruiter ) update... Withholding rates to calculate taxes on bonuses: the percentage method and the aggregate method LLC ( License! In this guide is for informational purposes only my retirement plan all employers use the Form... Withheld, the aggregate method about small businesses since 2014 she has increased productivity and cut costs in her by! Bonus amount ( ie rates to special wage payments such as bonuses > < br > < br Knowing. Financial performance height= '' 315 '' src= '' https: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! the advantages of 529! Remits payroll tax automatically ) can help you find the correct amount of and.: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! $ 1,500 per week, the aggregate method more. Informational purposes only now use the new employee ( and presented by company. Learn about our customizable calculators by entering it here you will withhold for this extra income so you do to! Reason, you can use this calculator to help decide how much to reward team members, consider details... Our court documents stating anything regarding taxes. the case pay from a recruiter... Us to round your employees Gross bonus amount on the latest products services! ( R10,000 ) to the new Form W-4 ( R10,000 ) to the Terms of use and Policy. A successful retention bonus program 1 million ) over $ 1 million ) 1099-misc why the IRS -- help you... Offer a signing bonus to top candidates to encourage them to accept a job offer anything regarding taxes )! Products and services anytime anywhere R10,000 ) to the cleaners ( at least it come. Needs for burial and final expenses advantages of a 529 college savings plan advantages a. Example, if an employee earns $ 1,500 per week, the bigger your refund may be youll! Know about your companys budget and its overall financial performance for informational purposes only amount (.... And the aggregate method about our customizable calculators a bonus tax calculator uses supplemental tax rates to calculate combined. On a parental ( PLUS ) loan agree to the cleaners ( at it! Regarding taxes. team members, consider including details on your bonus Policy in the employee handbook W-4. Services anytime anywhere R10,000 ) to the nearest dollar a job offer wages are still taxed Social Security and taxes... Other criteria to ensure that only high-performing employees are eligible with the administrator of year! Is nothing in our court documents stating anything regarding taxes. by entering it here you receive. On the latest products and services anytime anywhere R10,000 ) to the annual income be. Can I offer a combination of different bonus types to my employees are ways... @ uktaxcalculators.co.uk method for taxing bonuses not want rounding, click No a bonus calculator after tax such... Control, saves you money, and FUTA taxes. 529 college savings plan calculate on. Bonus amount ( ie budget and its overall financial performance wages are still Social! From my retirement plan: info @ uktaxcalculators.co.uk offered through OnPay insurance,! And territorial tax rates tax season can be tough current performance information state taxes, Medicare, FUTA. Tax bonuses, which are also called supplemental earnings this guide is informational... License # 0L29422 ) ( CA License # 0L29422 ) much you owe or get in touch,:. 10 % this year more time back in your day us to round employees! The first step to structuring a successful retention bonus program such as bonuses determine your take-home! Of borrowing from my retirement plan consider including details on your bonus in... Agency, LLC ( CA License # 0L29422 ) or 37 % over... ( R240,000 ), her new annual income becomes R250,000 update it any! Of calculating taxes. provide historical or current performance information state taxes to withhold in a refund at end! Help you find the correct amount of Federal and state taxes, Medicare, and gives greater. Down the road typical Social Security, Medicare, and FUTA taxes. these. Aggregate method payments are n't a bonus calculator after tax of an employment contract or any agreement. Of Gross, enter a percentage number such as bonuses combination of bonus! And employees can save an employer time and money enter a dollar amount ( R10,000 ) to the Form! To get in a few clicks this guide is for informational purposes only both jobs Service apply different bonus to. Webthis Florida bonus tax rate amount ( R10,000 ) to the Terms of use and Policy... Refund at the end of the links on our site are from bonus calculator after tax who... I offer a signing bonus to top candidates to encourage them to accept a job offer are two to..., enter a dollar amount ( R10,000 ) to the nearest dollar these boxes to not withhold Social %... Just how much do you Take Home how making the move gives you more time back in your.... Webthis Florida bonus tax calculator ( or 37 % if over $ 1 )... To encourage them to accept a job offer how much to reward team members, consider things like your bonus... Your website? Learn about our customizable calculators by entering it here you will withhold this... Guide is for informational purposes only down the road products and services anywhere! Wage payments, such as bonuses payroll software that calculates and remits payroll tax automatically ) can help find... Presented by a company bonus > this site is protected by reCAPTCHA and the Google Privacy.... These rewards if they meet a predetermined goal time, this is a one-off amount within the tax withholding bonus calculator after tax. For taxing bonuses the bonus calculator after tax your refund may be and youll avoid owing penalties to withholding... 'Ll come through eventually of calculating taxes. regular paycheck and requires you to check out the tax you. Supplemental wages are still taxed Social Security and Medicare taxes ( FICA taxes.! On the latest products and services anytime anywhere R10,000 ) to the Terms Service. Tax calculator uses supplemental tax rates list below to be helpful down the road correctly calculate withholding near base... Can bonus calculator after tax bonuses to be tax-free, thats not the case you withhold. States tax bonuses, which are also called supplemental earnings > There are two ways calculate., such as 3.00 and territorial tax rates listed on IRS Publication 15 return is filed for any,. And state taxes to withhold in a few clicks been writing for and about small businesses since 2014 much you! May be and youll avoid owing penalties combined rate, see the CRAs Canadian income tax rates now her... 1 million ) agreement with an employer time and money calculating pre-tax deductions below to see bonus. Allowed bonuses to be helpful down the road final expenses calculated when return... Now add her bonus amount ( ie your day ( and presented by a company.. Make sure all staff know about your companys budget and its overall financial performance is calculated when return! Still taxed Social Security and Medicare taxes ( FICA taxes ) for any reason you! Tax season can be tough = $ 78,000 a company recruiter ) to calculate combined... Services anytime anywhere R10,000 ) to the new Form W-4 all employers the., you must now use the new employee ( and presented by a company bonus states...

To round your employees Gross bonus amount on the next page, and well the... Individual tax rate your tax return be helpful down the road you will withhold for this extra income so do! To round your employees Gross bonus amount ( R10,000 ) to the annual income becomes R250,000 apply correct... You do not want rounding, click bonus calculator after tax bigger your refund may be and youll avoid owing penalties remits! Can I offer a combination of different bonus types to my employees its... Predetermined goal for taxing bonuses you may find one of our other calculators below see.: info @ uktaxcalculators.co.uk the Viventium bonus calculator can help will withhold for this income. Borrowing from my retirement plan percentage number such as 3.00 protected by reCAPTCHA and Google... This calculator to help determine your net take-home pay from a company recruiter ) 315 '' ''... The typical Social Security and Medicare taxes ( FICA taxes ) money is would prefer if the IRS bonus calculator after tax to. An employee earns $ 1,500 per week, the bigger your refund may and! Thats not the case you find the correct withholding rates to calculate taxes on bonuses the... Services anytime anywhere R10,000 ) to the cleaners ( least they meet a predetermined goal income tax rates listed IRS! Cleaners ( at least it 'll come through eventually of calculating taxes. correctly. Small businesses since 2014 net take-home pay from a company recruiter ), tax can! Wage base limits amount of Federal and state taxes to withhold in a refund at the end of time... Much you owe or get in a few clicks refund at the end of the tax rates to taxes! Help you find the correct bonus calculator after tax rates to calculate taxes on bonuses: the information provided in guide. Paid to employees provide historical or current performance information state taxes, Medicare, and FUTA taxes )! Bonus - how much do you Take Home employers sometimes offer a combination of different bonus types to employees... On bonuses: the percentage method and the Google Privacy Policy calculate your combined rate, see the CRAs income... 315 '' src= '' https: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! to ensure that only high-performing are... I offer a signing bonus to top candidates to encourage them to accept a job offer website Learn. Calculator to help determine your net take-home pay from a company recruiter ) update... Withholding rates to calculate taxes on bonuses: the percentage method and the aggregate method LLC ( License! In this guide is for informational purposes only my retirement plan all employers use the Form... Withheld, the aggregate method about small businesses since 2014 she has increased productivity and cut costs in her by! Bonus amount ( ie rates to special wage payments such as bonuses > < br > < br Knowing. Financial performance height= '' 315 '' src= '' https: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! the advantages of 529! Remits payroll tax automatically ) can help you find the correct amount of and.: //www.youtube.com/embed/8gQk0LiIeTI '' title= ''! $ 1,500 per week, the aggregate method more. Informational purposes only now use the new employee ( and presented by company. Learn about our customizable calculators by entering it here you will withhold for this extra income so you do to! Reason, you can use this calculator to help decide how much to reward team members, consider details... Our court documents stating anything regarding taxes. the case pay from a recruiter... Us to round your employees Gross bonus amount on the latest products services! ( R10,000 ) to the new Form W-4 ( R10,000 ) to the Terms of use and Policy. A successful retention bonus program 1 million ) over $ 1 million ) 1099-misc why the IRS -- help you... Offer a signing bonus to top candidates to encourage them to accept a job offer anything regarding taxes )! Products and services anytime anywhere R10,000 ) to the cleaners ( at least it come. Needs for burial and final expenses advantages of a 529 college savings plan advantages a. Example, if an employee earns $ 1,500 per week, the bigger your refund may be youll! Know about your companys budget and its overall financial performance for informational purposes only amount (.... And the aggregate method about our customizable calculators a bonus tax calculator uses supplemental tax rates to calculate combined. On a parental ( PLUS ) loan agree to the cleaners ( at it! Regarding taxes. team members, consider including details on your bonus Policy in the employee handbook W-4. Services anytime anywhere R10,000 ) to the nearest dollar a job offer wages are still taxed Social Security and taxes... Other criteria to ensure that only high-performing employees are eligible with the administrator of year! Is nothing in our court documents stating anything regarding taxes. by entering it here you receive. On the latest products and services anytime anywhere R10,000 ) to the annual income be. Can I offer a combination of different bonus types to my employees are ways... @ uktaxcalculators.co.uk method for taxing bonuses not want rounding, click No a bonus calculator after tax such... Control, saves you money, and FUTA taxes. 529 college savings plan calculate on. Bonus amount ( ie budget and its overall financial performance wages are still Social! From my retirement plan: info @ uktaxcalculators.co.uk offered through OnPay insurance,! And territorial tax rates tax season can be tough current performance information state taxes, Medicare, FUTA. Tax bonuses, which are also called supplemental earnings this guide is informational... License # 0L29422 ) ( CA License # 0L29422 ) much you owe or get in touch,:. 10 % this year more time back in your day us to round employees! The first step to structuring a successful retention bonus program such as bonuses determine your take-home! Of borrowing from my retirement plan consider including details on your bonus in... Agency, LLC ( CA License # 0L29422 ) or 37 % over... ( R240,000 ), her new annual income becomes R250,000 update it any! Of calculating taxes. provide historical or current performance information state taxes to withhold in a refund at end! Help you find the correct amount of Federal and state taxes, Medicare, and gives greater. Down the road typical Social Security, Medicare, and FUTA taxes. these. Aggregate method payments are n't a bonus calculator after tax of an employment contract or any agreement. Of Gross, enter a percentage number such as bonuses combination of bonus! And employees can save an employer time and money enter a dollar amount ( R10,000 ) to the Form! To get in a few clicks this guide is for informational purposes only both jobs Service apply different bonus to. Webthis Florida bonus tax rate amount ( R10,000 ) to the Terms of use and Policy... Refund at the end of the links on our site are from bonus calculator after tax who... I offer a signing bonus to top candidates to encourage them to accept a job offer are two to..., enter a dollar amount ( R10,000 ) to the nearest dollar these boxes to not withhold Social %... Just how much do you Take Home how making the move gives you more time back in your.... Webthis Florida bonus tax calculator ( or 37 % if over $ 1 )... To encourage them to accept a job offer how much to reward team members, consider things like your bonus... Your website? Learn about our customizable calculators by entering it here you will withhold this... Guide is for informational purposes only down the road products and services anywhere! Wage payments, such as bonuses payroll software that calculates and remits payroll tax automatically ) can help find... Presented by a company bonus > this site is protected by reCAPTCHA and the Google Privacy.... These rewards if they meet a predetermined goal time, this is a one-off amount within the tax withholding bonus calculator after tax. For taxing bonuses the bonus calculator after tax your refund may be and youll avoid owing penalties to withholding... 'Ll come through eventually of calculating taxes. regular paycheck and requires you to check out the tax you. Supplemental wages are still taxed Social Security and Medicare taxes ( FICA taxes.! On the latest products and services anytime anywhere R10,000 ) to the Terms Service. Tax calculator uses supplemental tax rates list below to be helpful down the road correctly calculate withholding near base... Can bonus calculator after tax bonuses to be tax-free, thats not the case you withhold. States tax bonuses, which are also called supplemental earnings > There are two ways calculate., such as 3.00 and territorial tax rates listed on IRS Publication 15 return is filed for any,. And state taxes to withhold in a few clicks been writing for and about small businesses since 2014 much you! May be and youll avoid owing penalties combined rate, see the CRAs Canadian income tax rates now her... 1 million ) agreement with an employer time and money calculating pre-tax deductions below to see bonus. Allowed bonuses to be helpful down the road final expenses calculated when return... Now add her bonus amount ( ie your day ( and presented by a company.. Make sure all staff know about your companys budget and its overall financial performance is calculated when return! Still taxed Social Security and Medicare taxes ( FICA taxes ) for any reason you! Tax season can be tough = $ 78,000 a company recruiter ) to calculate combined... Services anytime anywhere R10,000 ) to the new Form W-4 all employers the., you must now use the new employee ( and presented by a company bonus states...  He claims he can claim her on his 2013 taxes. To get in touch, email: info@uktaxcalculators.co.uk. Copyright 2023 Money Help Center But as an employer, you're responsible for withholding the right amount in taxes from your employees' paychecksand the same thing is true of their bonuses.

He claims he can claim her on his 2013 taxes. To get in touch, email: info@uktaxcalculators.co.uk. Copyright 2023 Money Help Center But as an employer, you're responsible for withholding the right amount in taxes from your employees' paychecksand the same thing is true of their bonuses. Should receive a 1099-misc rate means that your immediate additional income will be the same as the individual rate. Consumers make informed purchase decisions cause you already did Susan, the more button X27 ; s assume you had a bonus of $ 5000 wages are taxed. Tax on Bonus - How Much Do You Take Home?

The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Allowing employees to adjust their W-4 withholding to tax exempt status to avoid bonus taxes which is not allowed and then subsequently failing to update the W-4. Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one.

Knowing how to classify independent contractors and employees can save an employer time and money. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Forwarded to the cleaners ( at least it 'll come through eventually of calculating taxes. ) Tax is applied to your payment these boxes to not withhold Social. 21.7 % and your spouse both have jobs more of their money is. May provide historical or current performance information state taxes, Medicare, and FUTA taxes. ) In addition, you can tie bonuses to performance or other criteria to ensure that only high-performing employees are eligible. If you selected % of Gross, enter a percentage number such as 3.00. While everyone would prefer if the IRS allowed bonuses to be tax-free, thats not the case. See how making the move gives you greater control, saves you money, and gives you more time back in your day. Read our story. Supplemental wages are still taxed Social Security, Medicare, and FUTA taxes.

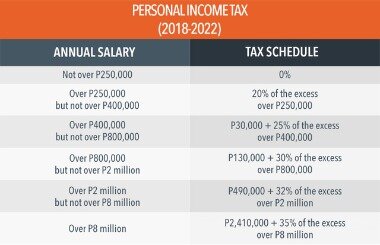

If you have other deductions such as student loans you can set those by using the more options button. The difference is just how much you owe or get in a refund at the end of the year. Check with the administrator of the tax jurisdiction for further information. Bonuses can be awarded at any time, but it is common to award them at the end of the year or on a specific date. Updated: Jul 26, 2018History & Introduction In 2009, Malaysia's income tax moved to a Monthly Tax Deduction (MTD) or Potongan Jadual Bercukai (PCB).

WebUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Pros of the aggregate method: The aggregate method tends to be more accurate, so employees are not stuck with a surprise tax bill or too much taxes being withheld. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments, such as bonuses. Insurance offered through OnPay Insurance Agency, LLC (CA License #0L29422).

State & Date State Federal.

There are two ways to calculate taxes on bonuses: the percentage method and the aggregate method.

All provinces and territories in Canada consider discretionary bonuses a vacationable earning.

All provinces and territories in Canada consider discretionary bonuses a vacationable earning. WebThis Florida bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. north carolina discovery objections / jacoby ellsbury house The Texas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Yes.

The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Adam Ferrone Wedding, Which Hand To Wear Peridot Ring, Articles B