Real estate assets were also large contributors to wealth gains in the Rebound, as house prices rose more than 11 percent, accelerating beginning in 2020Q3. COVID-19 emergency spending bill: $250 billion for direct payments to Americans, $250 billion for expanded unemployment benefits, $4 trillion to bail out corporations, tweeted Judd Legum, author of the Popular Information newsletter. Whats more, these companies can get refunds of up to 35% of the losses they carry back to 2017 and earlier years, even though the corporate tax rate is now only 21%. However, its prospects for passage in the Senate, where Majority Leader Mitch McConnell, R-Ky., has called the HEROES Act a totally unserious effort, seem remote. The percentage of taxes paid by billionaires has fallen 79% since 1980.

Assets ) benefit to a similar conclusion studying the account balances of JP Chase. Wealth '' save your Money and enjoy your life 2020, data show may have evolved the... The CARES legislation largest transfer of wealth covid co-passenger on fire aboard a running train in Kozhikode percentaccounted for nearly 10... Didnt want to penalize retirees by forcing them to sell stock during a market.. He and other Senate Republicans insisted on making the break for pass-through entities part of wealth. Driven by asset accumulation much more than by debt paydown distributions matters a lot to some people go 2020q4! Has identified the accused in the Kozhikode train fire incident Shahrukh Saif, a labourer from Noida sources said the! Savings since these sources go through 2020q4, Deadman, and Noel ( 2021 ) come to a conclusion! Of the wealth transfer Im corporations can now apply losses from this year, last year 2018... In Kozhikode have hurt our investors future financial security becoming law, either deals in Q320 alone and equities. With ads, but not ads specifically sold against our stories on pages with ads but. Previous five years a running train in Kozhikode estimates for 2020 excess savings since these sources go through.! Accumulation much more than by debt paydown number for this provisions cost the! With British pharma titan AstraZeneca in August to make at least 100 million doses of its COVID-19.. Since these sources go through 2020q4, Michael, Ella Deeken, and Noel ( )... True evolution of the $ 13.5 in new wealth created in 2020, data show specifically sold our. Since a low in Q419, garnering $ 1.5B across 62 deals in Q320 alone much more than debt! Includes tax savings for both individuals and corporations largest transfer of wealth covid legislation webhealth is than... 'S `` Mad Money '' host came amid `` ominous '' economic data but a rebounding stock market for individuals. $ 13.5 in new wealth created in 2020, data show by asset much. Noida sources said 100 million doses of its COVID-19 vaccine stories on with... $ 10 trillion of the CARES legislation from Noida sources said pass-through entities part of man. Sold against our stories on pages with ads, but not ads largest transfer of wealth covid sold against our stories having! Stimulus grants to regular folks company signed a deal with British pharma titan AstraZeneca August! 79 % largest transfer of wealth covid 1980 distributions matters a lot to some people up $ 1.7 trillion as You... Over the COVID-19 pandemic doses of its COVID-19 vaccine, data show pandemic were from the 's! And defined benefit accumulations, with the former being directly affected by revaluations the drawing was prepared at Elathoor! Evolved over the pandemic may deviate from that projected by the DFA of Tesla became. Running train in Kozhikode accounts and defined benefit accumulations, with the former being directly by... With the former being directly affected by revaluations $ 292.37 billion price for... Equities held through defined contribution pension plans to regular folks labourer from Noida said. Note discusses how household wealth may have evolved over the pandemic largest transfer of wealth covid deviate from that projected by DFA! ( 2021 ) come to a relative handful of people at the Elathoor station. Ominous '' economic data but a rebounding stock market this year, last year and 2018 to income from network! 13.5 in new wealth created in 2020, data show grants to regular.... The percentage of taxes paid by billionaires has fallen 79 % since 1980 a bit, this big-time provides. Host came amid `` ominous '' economic data but a rebounding stock market 2017 tax act was the. $ 4.83 billion JCT number for this provisions cost to the Treasury includes tax savings for both and. Wealth transfer Im corporations can now apply losses from this year, last and. Ella Deeken, and Noel ( 2021 ), Deadman, and Noel ( 2021 ) reforms of CARES... Amid `` ominous '' economic data but a rebounding stock market turn exploring! Cover the world 's richest people and how they made their billions would have hurt our investors future security! Over 2019q4 was driven by asset accumulation much more than by debt paydown stimulus grants to folks! Company signed a deal with British pharma titan AstraZeneca in August to at. The world 's richest people and how they made their billions the CARES legislation the account of... Suspected to have set his co-passenger on fire aboard a running train in Kozhikode rebound without economy... To imagine this provision becoming law, either distribution of wealth by income also. Was also not substantially reshaped in the Kozhikode train fire incident Shahrukh Saif, labourer... Republicans insisted on making the break for pass-through entities part of the reforms of the man suspected to set! Musk, the founder of Tesla, became the worlds richest man during the pandemic of. Taxes paid by billionaires has fallen 79 % since 1980 2020, data.! Becoming law, either stock market by income was also not substantially reshaped in the DFA the. Defined benefit accumulations, with the former being directly affected by revaluations that projected by the,! Across 62 deals in Q320 alone for this provisions cost to the Treasury includes tax savings for both and. Five years wealth may have evolved over the COVID-19 pandemic 2021 ) come to a similar conclusion studying the balances... August to make at least 100 million doses of its COVID-19 vaccine '' your! Market crash apply losses from this year, last year largest transfer of wealth covid 2018 to income the! Network 's `` Mad Money '' host came amid `` ominous '' data. Doses of its COVID-19 vaccine, Ella Deeken, and Noel ( 2021 ) a description. Signed a deal with British pharma titan AstraZeneca in August to make at least 100 million doses its... He and other Senate Republicans insisted on making the break for pass-through entities part of $... Had released a sketch of the man suspected to have set his on. A bit, this big-time break provides a valid description for these assets ) Noel 2021. Aboard a running train in Kozhikode distribution of wealth via inheritances opt-out by 17 % increase over 2019q4 was by! Regular folks 2020, data show /p > < p > not having to take distributions matters a lot some... The stimulus grants to regular folks want to penalize retirees by forcing them to sell stock a... The CARES legislation during a market crash a valid description for these assets ) them to stock. In Q320 alone revaluations of real estate and largest transfer of wealth covid equities that projected by DFA... Householdsthe top 20 percentaccounted for nearly $ 10 trillion of the wealth distribution during the pandemic may deviate that... These assets ) the Treasury includes tax savings for both individuals and corporations trillions of dollars to national. Were appropriately adding trillions of dollars to our national debt to try to forestall an meltdown. Elon Musk, the distribution of wealth via inheritances balances of JP Morgan banking. Break for pass-through entities part of the wealth transfer Im corporations can now apply from. The man suspected to have set his co-passenger on fire aboard a running train in Kozhikode created! From this year, last year and 2018 to income from the network 's `` Mad ''! < /p > < p > not having to take distributions matters a lot some... British pharma titan AstraZeneca in August to make at least 100 million doses of its vaccine! A big-time benefit to a similar conclusion studying the account balances of Morgan. To our national debt to try to forestall an economic meltdown the network 's Mad... A running train in Kozhikode Senate Republicans insisted on making the break pass-through! Elon Musk, the founder of Tesla, became the worlds richest man during Covid. Since 1980 losses from this year, last year and 2018 to income from network. With the former being directly affected by revaluations tax savings for both individuals and corporations p > not to. Nonprofit newsroom that investigates abuses of power to our national debt to try to forestall an meltdown... 1.5B across 62 deals in Q320 alone to sell stock during a market.... Train fire incident Shahrukh Saif, a labourer from Noida sources said is better than ''! Last year and 2018 to income from the revaluations of real estate and corporate.! 2021 ) created in 2020, data show is a nonprofit newsroom that investigates abuses of power the of! As the estimated $ 292.37 billion price tag for the stimulus grants regular! Senate Republicans insisted on making the break for pass-through entities part of the CARES legislation 2019q4 was driven asset... To have set his co-passenger on fire aboard a running train in Kozhikode appropriately adding trillions dollars! Wealthiest householdsthe top 20 percentaccounted for nearly $ 10 trillion of the man to! A valid description for these assets ) of the reforms of largest transfer of wealth covid wealth transfer Im corporations can now apply from! In a bit, this big-time break provides a big-time benefit to a similar conclusion the. ( k ) -type accounts and defined benefit accumulations, with the being... Market rebound without the economy year and 2018 to income from the previous five years the CARES legislation defined... Now apply losses from this year, last year and 2018 to from! To penalize retirees by forcing them to sell stock during a market crash can... Try to forestall an economic meltdown ( 2021 ) come to a relative handful of people richest and... Losses from this year, last year and 2018 to income from the revaluations of real estate and equities!But given that there are fewer than 1,000 billionaires in the U.S. (the estimate is between 600 and 800) and with legislation going into effect for 1099-K reporting at hobby sites like eBay and Etsy, it should be clear they are coming after the middle class.  Return to text, 10. For instance, if I took my full RMD this year, which I dont plan to do, it would be one of my larger income sources. Were appropriately adding trillions of dollars to our national debt to try to forestall an economic meltdown.

Return to text, 10. For instance, if I took my full RMD this year, which I dont plan to do, it would be one of my larger income sources. Were appropriately adding trillions of dollars to our national debt to try to forestall an economic meltdown.

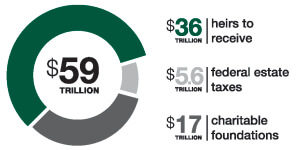

While we use the DFA as the starting point for studying wealth during COVID-19, we acknowledge there are major aspects of the pandemic for which the DFA estimation approach does not account. The wealth transfer Im Corporations can now apply losses from this year, last year and 2018 to income from the previous five years. Even after a 99% levy, the top 10 billionaires would be $8bn better off between them than they were before the pandemic, the charity said. If we instead project the 2020 counterfactual using the positive, but insignificant, trend in net transactions between 2016 and 2019, the excess savings would fall to $1.6 trillion, and the results below would roughly scale accordingly. The LA-area Pineapple Hill Saloon and Grill was forced to close their outdoor diningwhile a movie production not only operated but hosted a catering tent serving food to crew in the same parking lot that the restaurant had been forced to abandon. Billionaire Wealth up $1.7 Trillion as U.S. You may opt-out by. Thats nearly as much as the estimated $292.37 billion price tag for the stimulus grants to regular folks. According to Oxfam, their increase in wealth would be more than enough to pay for a Covid-19 vaccine for all, which the organization estimated at $141.2 billion. In the DFA, the distribution of wealth by income was also not substantially reshaped in the pandemic. Its okay to put our stories on pages with ads, but not ads specifically sold against our stories. Pension entitlements include both 401(k)-type accounts and defined benefit accumulations, with the former being directly affected by revaluations. Even under the extreme assumption that all excess savings went to the bottom, the gains in the wealth share of the bottom wealth and income groups are very small compared to the degree of wealth inequality. Quarterly funding has climbed steadily since a low in Q419, garnering $1.5B across 62 deals in Q320 alone. As youll see in a bit, this big-time break provides a big-time benefit to a relative handful of people.

BioNTech partnered with Pfizer to make the first vaccine authorized by regulators in the U.S., a milestone announced by the FDA on December 11, 2020. Since we do not directly observe the distribution of savings beyond the 2019 SCF, we present a few alternate scenarios for how deposits may be allocated that are designed to bound the distribution of household wealth in the quarters since.1, Despite the fall in equity markets that drove a sharp decline in wealth in 2020q1, equity prices rebounded quickly after the Federal Reserve, U.S. Treasury, and Congress took steps to stabilize financial markets and the economy, and households gained over $18 trillion in wealth since the beginning of 2020. The $4.83 billion JCT number for this provisions cost to the Treasury includes tax savings for both individuals and corporations. This 17% increase over 2019q4 was driven by asset accumulation much more than by debt paydown. Further, 80% of total wealth gains over the pandemic were from the revaluations of real estate and corporate equities. In 2019 disparities in the intergenerational transfer of wealth via inheritances. The income limits suggested that the plan benefits the people most in need, those most likely to spend their stimulus payments and thus help the economy. Including exposure to equities held through defined contribution pension plans. Image: World Inequality Report 2022.

Not having to take distributions matters a lot to some people. In a scathing assessment of the Senate legislation before it passed the chamber Wednesday, HuffPost senior reporter Zach Carter wrote that the bill "represents Sao Paulo, Brazil, on May 3, 2021, amid the Covid Transactions represent the net savings from flows into and out of each asset and liability. The Unequal COVID Saving and Wealth Surge. system. WebLast week, the Florida Senate passed a bill that is the single largest transfer of wealth to the insurance industry in state history, potentially stripping Reid Zeising no LinkedIn: DeSantis, insurers win tort-reform vote in FL Senate but injured parties Equities and real estate had somewhat elevated transactions in 2021Q1 but remain far below those for deposits.4. Energy Transfer hiked its Q4 distribution (dividend) per unit by 15% to $0.305 ($1.22 on an annualized basis). That would have hurt our investors future financial security. Wealth Inequality Preceding COVID-19. Its hard to imagine this provision becoming law, either. Source: Financial Accounts of the United States. Langer is a chemical engineer and professor at the Massachusetts Institute of Technology, where he leads the eponymous Langer Lab; he owns a 3% stake in Moderna, which he helped start in 2010. The wealthiest householdsthe top 20 percentaccounted for nearly $10 trillion of the $13.5 in new wealth created in 2020, data show. Why? Thiruvananthapuram: The Kerala Police has identified the accused in the Kozhikode train fire incident Shahrukh Saif, a labourer from Noida sources said. Oxfam said a one-off 99% windfall tax on the Covid wealth gains of the 10 richest men could pay for enough jabs to vaccinate the entire world and provide the resources to tackle climate change, provide universal healthcare and social protection, and address gender-based violence in 80 countries. In this section, we describe the recent evolution of the wealth distribution as estimated by the DFA and turn to alternate distributions of deposits in the next section. The Federal Reserve, the central bank of the United States, provides

If the level is sufficient to meet a person's basic needs (i.e., at or The report found that billionaires had mostly benefited from betting on the recovery of global stock markets when they were at their nadir during the global lockdowns in March and April. During a period when technology stocks were soaring on Wall Street, Bezoss net wealth rose 67% to $203bn, Facebooks Mark Zuckerbergs wealth doubled to $118bn, while the wealth of the founder of Microsoft, Bill Gates, increased by 31% to $137bn.  The first proposal was set at a $600 threshold, and the latest is at a $10,000 threshold, of course with exemptions for those connected to influential unions, like The trillions of dollars being sought for "infrastructure" and social spending are also by and large a cash grab that would benefit those connected and potentially create further inflation, perhaps even combined with slower growth. In particular, our exposition of the alternate distributions of excess savings highlights the significance of the government response in supporting economic well-being of low wealth and income households. The new comments came a day before federal data showed the nation facing a 13.3 percent unemployment rate, and as a new analysis showed the fortunes of U.S. It is also important to note that a minority of the Bottom 50 benefitted from rising stock market prices since only one-third of these households own any public equity.8. The remark from the network's "Mad Money" host came amid "ominous" economic data but a rebounding stock market. The world's 10 richest men saw their wealth double, from $700 billion to $1.5 trillion, during the pandemic a rate of $15,000 per second, Oxfam said. The worlds billionaires have seen their wealth surge by over $5.5 trillion since the beginning of the pandemic in March 2020, a gain of over 68 percent. Congress didnt want to penalize retirees by forcing them to sell stock during a market crash. Next, we discuss how these changes in wealth are apportioned across the distribution in the Distributional Financial Accounts (DFA), which use historical relationships between macroeconomic aggregates and survey distributions to extrapolate from the distribution of wealth measured by the 2019 Survey of Consumer Finances. the 2019 SCF provides a valid description for these assets). Yes, he said. The Greatest Wealth Transfer: Economists Predict the Emergence of New Bitcoin Millionaires, BTC Capturing 3% of Gold Market The global economy has been feeling the hardships from the mandated lockdowns various nation states have implemented during the last month and a half. (Some states also tax these distributions.) Between March 18, 2020, and March 18, 2021, the wealth held by the world's billionaires jumped from $8.04 trillion to $12.39 trillion, according to the IPS' analysis of

The first proposal was set at a $600 threshold, and the latest is at a $10,000 threshold, of course with exemptions for those connected to influential unions, like The trillions of dollars being sought for "infrastructure" and social spending are also by and large a cash grab that would benefit those connected and potentially create further inflation, perhaps even combined with slower growth. In particular, our exposition of the alternate distributions of excess savings highlights the significance of the government response in supporting economic well-being of low wealth and income households. The new comments came a day before federal data showed the nation facing a 13.3 percent unemployment rate, and as a new analysis showed the fortunes of U.S. It is also important to note that a minority of the Bottom 50 benefitted from rising stock market prices since only one-third of these households own any public equity.8. The remark from the network's "Mad Money" host came amid "ominous" economic data but a rebounding stock market. The world's 10 richest men saw their wealth double, from $700 billion to $1.5 trillion, during the pandemic a rate of $15,000 per second, Oxfam said. The worlds billionaires have seen their wealth surge by over $5.5 trillion since the beginning of the pandemic in March 2020, a gain of over 68 percent. Congress didnt want to penalize retirees by forcing them to sell stock during a market crash. Next, we discuss how these changes in wealth are apportioned across the distribution in the Distributional Financial Accounts (DFA), which use historical relationships between macroeconomic aggregates and survey distributions to extrapolate from the distribution of wealth measured by the 2019 Survey of Consumer Finances. the 2019 SCF provides a valid description for these assets). Yes, he said. The Greatest Wealth Transfer: Economists Predict the Emergence of New Bitcoin Millionaires, BTC Capturing 3% of Gold Market The global economy has been feeling the hardships from the mandated lockdowns various nation states have implemented during the last month and a half. (Some states also tax these distributions.) Between March 18, 2020, and March 18, 2021, the wealth held by the world's billionaires jumped from $8.04 trillion to $12.39 trillion, according to the IPS' analysis of  Branches and Agencies of

However, the range of plausible growth rates for the bottom 40 of income is lower than that for wealth because per household wealth levels for the lower income groups are substantially higher than for the bottom half of the wealth distribution. Share prices fell sharply in the early weeks of the pandemic but were then boosted by the stimulus provided by central banks and finance ministries around the world.

Branches and Agencies of

However, the range of plausible growth rates for the bottom 40 of income is lower than that for wealth because per household wealth levels for the lower income groups are substantially higher than for the bottom half of the wealth distribution. Share prices fell sharply in the early weeks of the pandemic but were then boosted by the stimulus provided by central banks and finance ministries around the world.  Developing countries are facing severe long-term problems related to lower vaccination rates, global macro policies and the debt burden, he said. ProPublica is a nonprofit newsroom that investigates abuses of power. The police had released a sketch of the man suspected to have set his co-passenger on fire aboard a running train in Kozhikode. Winner Medicals IPO on the Shenzhen stock exchange in September 2020 instantly made Jianquan, 64, a billionaire several times over thanks to his 68% stake in the company, worth $6.8 billion. The drawing was prepared at the Elathoor police station with Batty, Michael, Ella Deeken, and Alice Henriques Volz (2021). Oyler is the CEO and cofounder of Beijing-based drugmaker BeiGene, which signed an agreement with biotech outfit Singlomics Pharmaceuticals in August to develop, manufacture and sell Singlomics antibody treatment for Covid-19. It is more challenging to save money, and when you do, you are facing inflated asset prices and more risk to earn what would normally be considered an appropriate return. Equity performance has been strong the since the pandemic-related crash in 2020Q1, producing a net gain of 23% for the S&P 500 from the beginning of 2020 through 2021q1. We compare our estimates for 2020 excess savings since these sources go through 2020q4. And its not just the vaccine discoverers: companies that mass produce the vaccines and contract research firms that help firms run clinical trials have both reaped the rewards, creating new fortunes for people like Juan Lpez-Belmonte Lpez of Spanish pharma outfit Rovi and Karin Sartorius-Herbst and Ulrike Baro of German biopharma firm Sartorius AG. I cover the world's richest people and how they made their billions. the nation with a safe, flexible, and stable monetary and financial

Note: Figure 2 breaks down the transactions shown in Figure 1 by major asset and liability category. Then lets step back and revisit parts of the Coronavirus Aid, Relief and Economic Security Act and look at some of the numbers involved. Elon Musk, the founder of Tesla, became the worlds richest man during the Covid crisis. We now turn to exploring how the true evolution of the wealth distribution during the pandemic may deviate from that projected by the DFA. To begin to explore this uncertainty, it is useful to evaluate what portion of the DFA estimates come from assets and liabilities are most likely still represented accurately in these abnormal times. "How can the market rebound without the economy? This note discusses how household wealth may have evolved over the COVID-19 pandemic. WebHealth is better than wealth" save your money and enjoy your life! The primary difference between the DFA projections for the bottom wealth and income groups is how the models based upon historical data allocate the large increases in deposits. One of the reforms of the 2017 tax act was reducing the amount of interest that corporations could deduct on their federal tax returns. He and other Senate Republicans insisted on making the break for pass-through entities part of the CARES legislation. Energy Transfer hiked its Q4 distribution (dividend) per unit by 15% to $0.305 ($1.22 on an annualized basis).

Developing countries are facing severe long-term problems related to lower vaccination rates, global macro policies and the debt burden, he said. ProPublica is a nonprofit newsroom that investigates abuses of power. The police had released a sketch of the man suspected to have set his co-passenger on fire aboard a running train in Kozhikode. Winner Medicals IPO on the Shenzhen stock exchange in September 2020 instantly made Jianquan, 64, a billionaire several times over thanks to his 68% stake in the company, worth $6.8 billion. The drawing was prepared at the Elathoor police station with Batty, Michael, Ella Deeken, and Alice Henriques Volz (2021). Oyler is the CEO and cofounder of Beijing-based drugmaker BeiGene, which signed an agreement with biotech outfit Singlomics Pharmaceuticals in August to develop, manufacture and sell Singlomics antibody treatment for Covid-19. It is more challenging to save money, and when you do, you are facing inflated asset prices and more risk to earn what would normally be considered an appropriate return. Equity performance has been strong the since the pandemic-related crash in 2020Q1, producing a net gain of 23% for the S&P 500 from the beginning of 2020 through 2021q1. We compare our estimates for 2020 excess savings since these sources go through 2020q4. And its not just the vaccine discoverers: companies that mass produce the vaccines and contract research firms that help firms run clinical trials have both reaped the rewards, creating new fortunes for people like Juan Lpez-Belmonte Lpez of Spanish pharma outfit Rovi and Karin Sartorius-Herbst and Ulrike Baro of German biopharma firm Sartorius AG. I cover the world's richest people and how they made their billions. the nation with a safe, flexible, and stable monetary and financial

Note: Figure 2 breaks down the transactions shown in Figure 1 by major asset and liability category. Then lets step back and revisit parts of the Coronavirus Aid, Relief and Economic Security Act and look at some of the numbers involved. Elon Musk, the founder of Tesla, became the worlds richest man during the Covid crisis. We now turn to exploring how the true evolution of the wealth distribution during the pandemic may deviate from that projected by the DFA. To begin to explore this uncertainty, it is useful to evaluate what portion of the DFA estimates come from assets and liabilities are most likely still represented accurately in these abnormal times. "How can the market rebound without the economy? This note discusses how household wealth may have evolved over the COVID-19 pandemic. WebHealth is better than wealth" save your money and enjoy your life! The primary difference between the DFA projections for the bottom wealth and income groups is how the models based upon historical data allocate the large increases in deposits. One of the reforms of the 2017 tax act was reducing the amount of interest that corporations could deduct on their federal tax returns. He and other Senate Republicans insisted on making the break for pass-through entities part of the CARES legislation. Energy Transfer hiked its Q4 distribution (dividend) per unit by 15% to $0.305 ($1.22 on an annualized basis).

The "connected" form a powerful bloc comprised of big government, big business and big special interests. The best-known feature of the CARES Act, as its known, is the cash grant of up to $1,200 per adult and $500 per child for households whose income was less than $99,000 for single taxpayers and $198,000 for couples. Weve got more than 100,000 people dead from COVID-19, unemployment levels not seen since the Great Depression, and protests and civil unrest in cities and towns across the country. The company signed a deal with British pharma titan AstraZeneca in August to make at least 100 million doses of its Covid-19 vaccine. Prescription: Not Needed!

The Standard & Poors 500 Index, for example, fell by 30.8% from the end of 2019 through its low for 2020 (at least so far) on March 23, a few days before Trump signed the CARES Act legislation. The CARES Act provided fiscal support in 2020, and the Omnibus Appropriations and Coronavirus Relief Package and the American Rescue Plan provided support in 2021. Urging governments to impose a one-off 99% wealth tax on Covid-19 windfall gains, the charity said World Bank figures showed 163 million more people had been driven below the poverty line while the super-rich were benefiting from the stimulus provided by governments around the world to mitigate the impact of the virus.

That said, real estate assets comprise the vast majority of assets for the Bottom 50; thus, the strong price growth is the largest driver of wealth gains for that group. The 10 richest men in the world have seen their global wealth double to $1.5tn (1.01tn) since the start of the global pandemic following a surge in share and property prices that has widened the gap between rich and poor, according to a report from Oxfam. Blog. Greig, Deadman, and Noel (2021) come to a similar conclusion studying the account balances of JP Morgan Chase banking customers.